Financial Movements

The financial transactions ledger within the Metrix Asset Management system tracks the financial consumption and restoration of asset components over their lifetime. This data is then collated in a number of system reports that satisfy the financial reporting obligations of user organisations. The following outlines a number of terms used throughout the system, and how they tie into the financial frameworks in force.

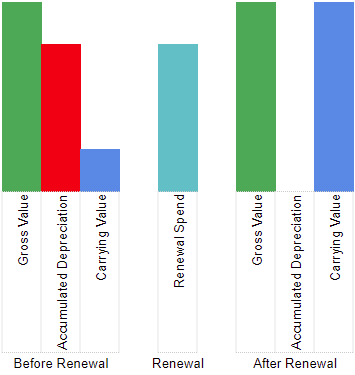

Gross Value

The replacement cost of a component at the time of valuation (or revaluation). Gross value can increase or decrease over the life of a component through intervention actions such as additions or upgrades to the asset component. Another way that gross value increases or decreases is through indexation – this is essentially increasing the value of a component by a percentage amount, typically in line with CPI.

Accumulated Depreciation Value

The accumulated depreciation of a component is the sum of all depreciation transactions logged against it over its life time.

The formula for accumulated depreciation is:

$$ \sum [Depreciation Charges] $$In the Metrix Asset Management system, the accumulated depreciation is posted as a NEGATIVE NUMBER to reflect the fact that it is a ‘consuming’ factor.

Consider a road surface Component for a road Asset. The initial gross value for the component is $123,000.

Each year, the component incurs a depreciation charge of -$8,200. After 5 financial year periods (assuming

no other depreciation events occur) the accumulated deprecation would be:

Carrying Value

The carrying value of a component is the net worth of the component to the entity in adjusted terms. Carrying value is a calculated value that deducts the accumulated depreciation from the gross value. Given that the depreciation figure is already stored within the Metrix Asset Management system as a negative figure however, the formula for carrying value is:

$$ [Gross Value] + \sum [Depreciation Charges] $$Consider again, the road surface component from the previous example. The accumulated deprecation is calculated

to be -$41,000

The carrying value** for the component after this 5 years period is therefore:

$$ $123,000 + (-$41,000) = $82,000 $$Renewals and Depreciation

In the Metrix Asset Management system, a renewal expenditure is typically posted as a POSITIVE movement against the components accumulated depreciation. This is to recognise the fact that the action has ‘undone’ the financial consumptions of the past. In turn, the components carrying value (assuming renewal costs equal gross value and a fully depreciated component) is restored to its original gross value as expected.